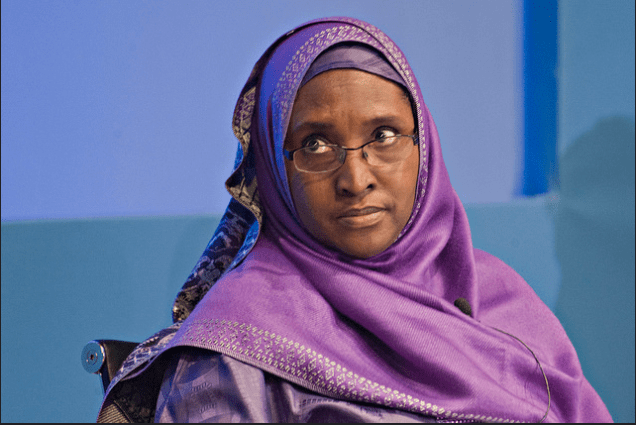

Zainab Ahmed

The minister of Finance, Budget and National Planning, Mrs Zainab Ahmed, recently revealed this in a maiden special media briefing by the MDAs organized by the Presidential Communications Team at the Presidential Villa, Abuja.

According to her, Nigeria cannot make any meaningful headway in its quest for development if it doesn’t borrow more than it already has.

She added that even if Nigeria has expanded its borrowing, the nation is still below 25% debt to GDP ratio, so FG is well within borrowing limit.

Her words, “I think it’s useful to look at the budget for each year; look at the revenues, look at the expenditure, if you take out the new borrowing, really, what will the size of the budget be? How much can the government spend?”

“So, there will be a lot of capital projects that are affected. So, we need to look at it that borrowing is, even as you see it in the budget every year, used to support infrastructural development. Otherwise, there will be a challenge.”

“Secondly, let me add. I think we’re going through a process where we need to borrow now. Let’s just say in the short to medium term, to get the economy going, while we also expect revenues to improve.”

“So, in terms of the pressure of debt service, by the time the revenue comes up, that should be lower, but there are some things you need to do now, to ensure that revenue comes up. So, we need to keep that in mind that if the economy grows and revenues improve, then debt service to revenue, in future, should be lower.”

“There is a lot of sensitivity in Nigeria about the level of borrowing by the government and it is not misplaced. And I said earlier that the level of borrowing is not unreasonable, it is not high.”

“The problem we have is that of revenue. So, what we need to do is to increase revenue to be able to enhance our debt to GDP obligation capacity.”

“If we say we will not borrow and therefore not build rails and major infrastructure until our revenue rises enough, then, we will regress as a country.”

“We will be left behind, we won’t be able to improve our business environment and our economy will not grow. So, it is a decision that every government has to take.”

“Our assessment is that we need to borrow to build our major infrastructure. We just need to make sure that when we borrow, we are applying the borrowing to specific major infrastructure that will enhance the business environment in this country.”

“Again, we all have to work not just the federal government but state governments to increase our revenue to enhance our debt service obligations.”

“We also have to make sure that when we are choosing the projects, we are choosing carefully the ones that will enhance business environment so that more revenue yields come into the treasuries of the country.”

“The total borrowing of the country as at 31st of December is 21.6% of the GDP.”

“So, if we were not looking at adding the other category of loans that I mentioned, we don’t even need to increase that at this time. As at 2019, the debt to GDP ratio was 19.2%. So, only 2 per cent was added.”

“As we see the oil price rising and provides us with more revenue, it provides us with some reliefs. We will be able to reduce our borrowing. So, it is a positive thing for us.”

NaijaVibe NaijaVibe | Download Latest Nigerian Music & Mp3s

NaijaVibe NaijaVibe | Download Latest Nigerian Music & Mp3s